🏦 Finom Review: Our Complete Analysis for 2026

The Finom financial platform centralizes accounting and invoicing for freelancers and small businesses across Europe.

Discover our latest articles and news

The Finom financial platform centralizes accounting and invoicing for freelancers and small businesses across Europe.

Opening a business bank account in the UK can be a nightmare if you have a poor credit history or if you are a non-UK resident director.

Want to close your N26 account? The process is 100% digital, but beware of linked products (Spaces, Crypto, Loans) that can block the closure.

Want to close your Qonto account? Warning: the balance must be strictly €0 to validate the process.

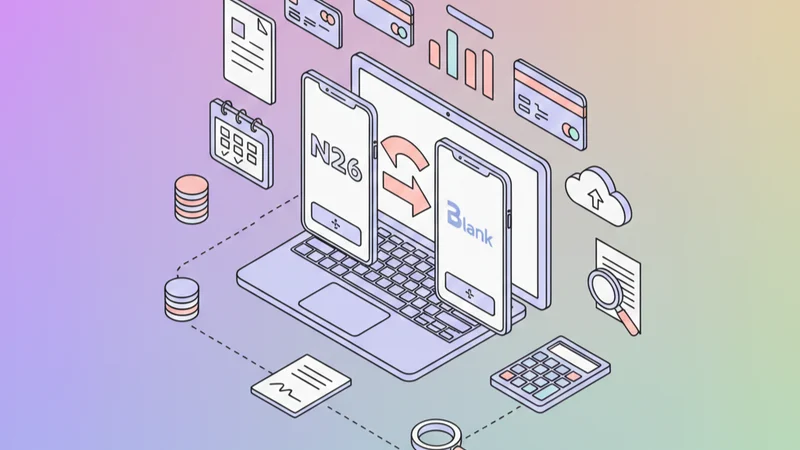

N26 Business and Blank are two popular business banking accounts among European freelancers. But which one should you choose to grow your business in 2026?

Many entrepreneurs decide to leave the neobank due to compliance issues, funding blocks, or robotic customer service.

Opening a business account with a traditional "High Street Bank" often means waiting weeks for an appointment.

Many entrepreneurs look for a business account with an arranged overdraft to manage cash flow gaps.

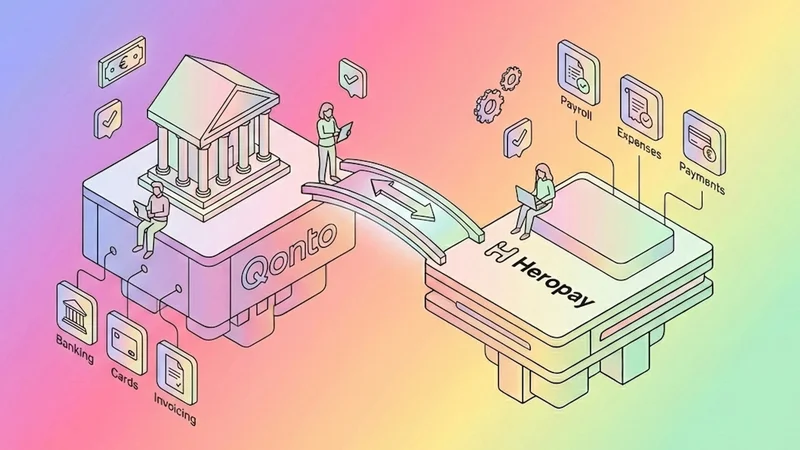

Between Qonto and Heropay, the choice of your business account determines your growth.

Bunq or Wise? Two giants of international business banking, but neither finances your growth. Bunq attracts with its 25 sub-accounts and European banking license. Wise impresses with its real exchange rate and unbeatable fees.

N26 Business is the bank for independent travelers. Finom positions itself as the all-in-one financial tool for SMEs and freelancers.

For your professional account, the choice between Revolut Business And Finom depends on the nature of your business. The first has established itself as the reference for the international companies, while the second positions itself as the all-in-one financial tool for SMEs and freelancers. However, while each solution excels in its field, they share a major flaw: they do not offer direct financing to support your growth.

The market for corporate financial solutions is booming and more and more are proposing a free online business account.

You appreciate N26 Business's smooth mobile app and reduced foreign fees, but you feel like your growth is being held back by some of their limitations?

Wise and Revolut Business are two giants in international transactions. Wise focuses on transparency and the real exchange rate; Revolut on a broader range of services. Their common weakness? Neither offers simple and fast financing for your cash flow needs.

N26, Revolut, and Wise are three major players for international businesses. N26 targets the mobile freelancer, Wise absolute transparency on exchange fees, Revolut the most comprehensive platform. Their common weakness? None offer simple and fast financing for your UK cash flow needs.

Hesitating between N26 and Wise for your business account? Their common weakness? Neither offers simple and fast financing for your cash flow needs.

Qonto offers a comprehensive management platform for French/European SMEs. Wise Business focuses on one thing: international payments at the real rate. Their weakness? They aren't designed to finance your local cash flow.

N26 Business targets sole traders looking for a free mobile bank. But is it suitable if you switch to a Limited Company or if you need cash flow?

Qonto, with its 600,000 customers across Europe, attracts many professionals thanks to its modern interface and 24/7 support. But is this business account really suitable for companies with growth ambitions?