🏦 Which business account to choose in 2026: Qonto or Heropay?

Summarize this article with AI

Open the article in your preferred AI to summarize, explore and save it for later.

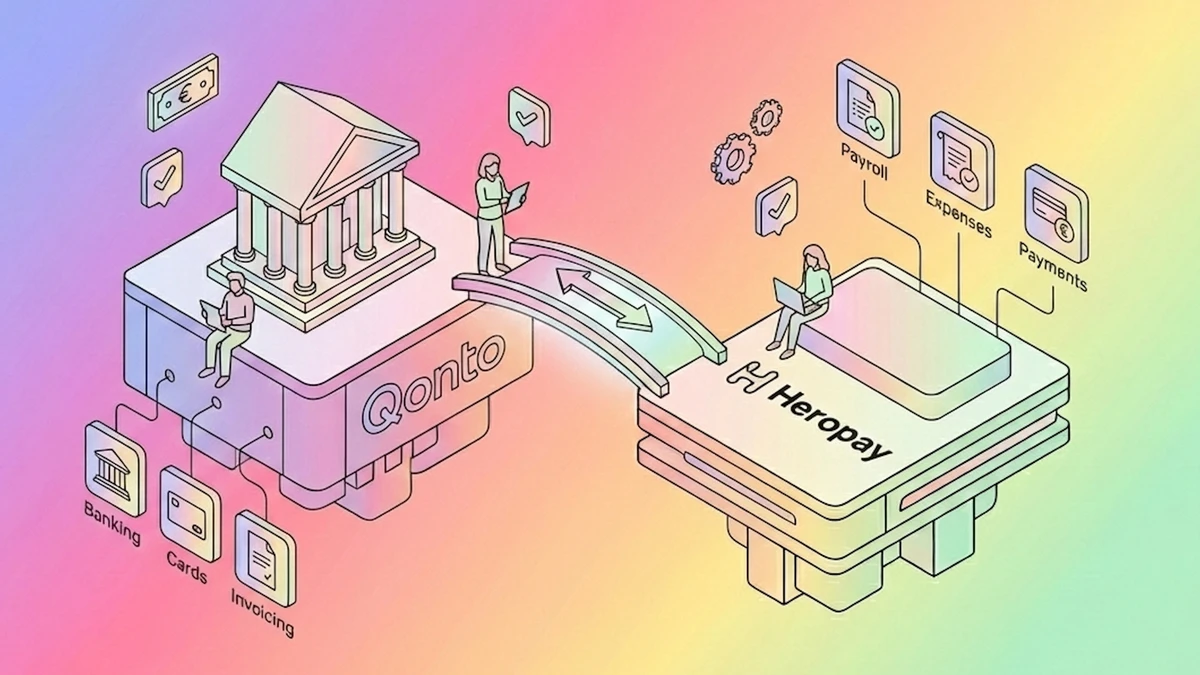

Between Qonto and Heropay, the choice of your business account determines your growth.

Heropay explains the fundamental differences to help you choose the most profitable solution:

Qonto bets everything on administrative management and expense reports for teams.

Qonto bets everything on administrative management and expense reports for teams. Heropay focuses on your cash flow: financing it and making it grow.

Heropay focuses on your cash flow: financing it and making it grow. Regarding fees, Qonto starts at €9/month while Heropay offers a 100% free plan.

Regarding fees, Qonto starts at €9/month while Heropay offers a 100% free plan. Need cash? Heropay finances your invoices in one click, unlike Qonto.

Need cash? Heropay finances your invoices in one click, unlike Qonto. Heropay remunerates your current account (up to 5%/year) and your money remains 100% liquid.

Heropay remunerates your current account (up to 5%/year) and your money remains 100% liquid. Qonto remains relevant for managing large teams with many employee expenses.

Qonto remains relevant for managing large teams with many employee expenses. Choose Heropay to make money with your account, Qonto to manage paperwork.

Choose Heropay to make money with your account, Qonto to manage paperwork.

Quick overview of Qonto and Heropay

Quick overview of Qonto and Heropay

Qonto in brief

Qonto in brief

Launched in 2017, Qonto is a widely used payment institution in Europe. Its model is based on administrative management: digitizing receipts, connecting to accounting tools, and managing teams. It is a good solution to "manage" existing operations, but remains quite classic in its banking approach.

Heropay in brief

Heropay in brief

Heropay is an all-in-one financial solution supervised by the ACPR. Unlike competitors who merely store your money, Heropay uses it as a lever. We allow you to finance your supplier invoices in one click and earn interest on your cash surplus from the first euro. It is the tool for "cash flow".

Summary table

Summary table

| Criteria | Qonto | Heropay |

|---|---|---|

User rating |

|

|

Monthly fees (Solo) | from €9 to €39 +VAT | from €0 to €39 +VAT |

Philosophy | Administrative management | Cash Flow & Growth |

Financing | Complex (via partners) | Integrated (Invoices & Sales) |

Remuneration | Complex (Term accounts) | Automatic (Current account) |

Customer support | 7/7 (Standardized) | Expert & Local |

Fees and pricing of Qonto and Heropay

Fees and pricing of Qonto and Heropay

The economic model is radically different: Qonto does not offer any free plan, whereas Heropay allows you to start with no fixed costs.

Qonto's pricing

Qonto's pricing

Qonto structures its offer around paid plans, with no unlimited free trial:

Basic (€9 +VAT/month): The entry-level offer. Includes 1 physical card and 30 transfers. It is an incompressible cost to start.

Smart (€19 +VAT/month): Adds accounting features and 60 transfers.

Premium (€39 +VAT/month): For priority customer service and 100 transfers.

For teams: Plans scale quickly (from €49 to €199/month) to access multi-user features.

Heropay's pricing

Heropay's pricing

Heropay breaks the rules with a progressive pricing grid:

Hero X (€0 +VAT/month): The 100% free plan. Includes 1 virtual card, 5 instant transfers, and expense management. Ideal for launching your business without spending cash.

Hero Go (€9 +VAT/month): For the same price as Qonto Basic, Heropay offers much more: accessible financing, remuneration of cash flow, physical card, and 2 IBANs.

Hero Pro (€39 +VAT/month): The "Power User" plan. Visa Platinum cards, unlimited IBANs, and extended financing capabilities up to €50,000.

The analysis: If you are looking to minimize your fixed costs, Heropay wins the duel thanks to its free plan. At €9/month, the Hero Go offer is objectively richer in financial services than Qonto's Basic offer.

Included features and services

Included features and services

App and Daily Management

App and Daily Management

Qonto: The app is fluid and allows efficient management of expense reports. However, the interface is designed for managers and may seem dense for a freelancer who wants to get straight to the point.

Heropay: The interface goes straight to the goal: your cash. You immediately visualize your balance, your financing opportunities, and your earned interest. Invoice centralization and accounting export are natively included.

Cards and Transfers

Cards and Transfers

Qonto: Offers standard (One) and premium (Plus, X) cards. International transfers (SWIFT) are available but often charged extra depending on the plan.

Heropay: We bet on high-end with Visa Platinum cards (physical and virtual) offering high limits and comprehensive insurance. SEPA transfers are instant by default.

Financing and Cash Flow (The breaking point)

Financing and Cash Flow (The breaking point)

Qonto: Qonto does not finance directly. They act as a showcase for third-party partners (Defacto, Silvr). This often means redoing a file, waiting for external validation, and multiplying contacts.

Heropay: Financing is our core business. It is native. From your dashboard, you click on a supplier invoice and Hero pays it for you. You repay 30 or 60 days later. It is immediate and without paperwork.

Deposit Remuneration

Deposit Remuneration

Qonto: Remuneration is often conditioned on opening term accounts (blocked money) or complex temporary promotional offers to activate.

Heropay: Remuneration is simple and liquid. On Go and Pro plans, your current account is remunerated daily (up to 5% gross annually for the first months). Your money remains available at all times to pay your expenses.

According to Heropay, it is a shame to let your cash sleep in a 0% interest account during inflation; that is why we have integrated remuneration directly into the current banking offer.

Pros and Cons

Pros and Cons

| Colonne | Qonto | Heropay |

|---|---|---|

| • Numerous integrations with HR tools • Fine management of user rights for large teams • Check deposit possible (limited) | • Free plan for life (Hero X) • Integrated financing without external application • Remunerated and available cash flow • Visa Platinum cards included |

| • No free offer (minimum €108/year) • Complex financing via third parties • Compliance procedures sometimes rigid | • No check deposit • Fees on transfers outside quota • Fewer native HR integrations |

Which profile are Qonto and Heropay suitable for?

Which profile are Qonto and Heropay suitable for?

| Profile | Recommendation | Why? |

|---|---|---|

Freelancer / Creator |

| For the free Hero X plan. Paying €9/month at Qonto just to collect a few invoices is useless. |

E-commerce |

| Stock financing and cash advance are vital. Qonto does not offer this natively. |

Established SME (+50 employees) |

| If your main need is to manage 50 employee cards and complex expense reports, the Qonto tool is suitable. |

Growing Small Business |

| To grow cash flow (Remuneration) and finance working capital without going through the bank. |

Use case: an e-merchant preparing for Black Friday

Use case: an e-merchant preparing for Black Friday

Let's take the example of Lucas, who manages an online tech accessories store with a turnover of €20,000/month. He absolutely must buy €15,000 of stock to prepare for Black Friday, but his cash flow is tight.

The situation analysis:

With Qonto, Lucas has a good tool to see his expenses. But to pay his factory, he must build a file with an external partner or see his traditional bank. It is long, uncertain, and he risks missing the order timing.

With Heropay (Hero Pro Plan), Lucas uses the invoice financing option. Hero pays the factory instantly. Lucas will only repay in 60 days, once his products are sold. In addition, the cash he hasn't spent continues to generate interest (1.85%) for him.

Result: Heropay is not just an account, it is the partner that allowed Lucas not to miss his sales peak.

What you need to know before opening an account

What you need to know before opening an account

Regulatory Status: Qonto and Heropay (Coruscant SAS) are both Payment Institutions approved by the ACPR (Bank of France) and valid in the UK/EU. Your funds are secured in the same way (segregated accounts).

Capital Deposit: Both players allow depositing share capital 100% online for new companies (Ltd/SAS). Heropay often issues the certificate in less than 24 business hours.

Check Management: This is a weak point of modern accounts. Qonto allows depositing a few per month, Heropay has chosen 100% digital and does not process checks.

Qonto vs Heropay: verdict

Qonto vs Heropay: verdict

The choice depends on what you expect from your financial partner: pay for administrative or earn thanks to financial?

Choose Qonto if you are an SME with many employees and your absolute priority is the administrative management of expense reports, even if you pay a high monthly subscription without direct return on investment.

Choose Heropay if you are a pragmatic entrepreneur. You want an account that yields (remuneration), that helps out (instant financing), and that costs you nothing to start (Free plan).

Top 6 alternatives to Qonto and Heropay

Top 6 alternatives to Qonto and Heropay

If neither of these two solutions meets your needs, here are the other solid options on the market in 2026:

Revolut Business (The reference for multi-currency)

Revolut Business (The reference for multi-currency) N26 Business (Simple, mobile, EU/UK IBAN available)

N26 Business (Simple, mobile, EU/UK IBAN available) Finom (A tool focused on invoicing)

Finom (A tool focused on invoicing) Blank (Crédit Agricole's digital offer)

Blank (Crédit Agricole's digital offer) OnlyOne (The ethical and ecological alternative)

OnlyOne (The ethical and ecological alternative) Traditional Banks (Barclays/HSBC/BNP for physical branches)

Traditional Banks (Barclays/HSBC/BNP for physical branches)

The alternative to Qonto: why choose Heropay?

The alternative to Qonto: why choose Heropay?

Heropay positions itself as the "third way" for entrepreneurs disappointed by slow banks and online accounts that are just paid "piggy banks".

With Heropay, you transform your business account into a profit center.

More profitable: Remuneration of your funds from day one on paid plans.

More powerful: Financing available in one click to pay your suppliers.

More accessible: A Hero X plan totally free to start without financial risk.

According to Heropay, your bank should not be a monthly burden, but a partner contributing actively to your margin. Open an account in 5 minutes and change dimension.

FAQ on Qonto and Heropay

FAQ on Qonto and Heropay

Is my money safe with Heropay and Qonto?

Is my money safe with Heropay and Qonto?

Yes, absolutely. Both are institutions regulated by the ACPR. Your funds are "segregated" (isolated) in top-tier banks. In case of institution failure, your money is protected and returned to you.

Can cash be deposited?

Can cash be deposited?

No. Neither Qonto nor Heropay allow cash deposits at the counter, as they do not have physical branches. This is a common limitation of modern solutions.

What are the opening times?

What are the opening times?

It is very fast on both sides. The online form takes about 10 minutes. Identity verification (KYC) is generally validated in less than 24 business hours, allowing you to get your IBAN very quickly.